Asset Class Returns - 1/31/2025

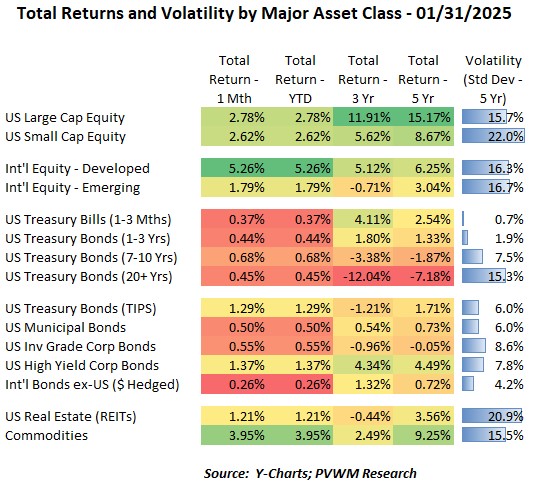

With no negative returns for the major asset classes in the table above, even the “+”s have red in the relative color-shaded boxes! That wasn’t the case at the beginning of the month when rates were rising and equity markets were drifting lower, with US REITs down close to 4% early in the month. By mid-month, rates began falling after a more stable inflation report and markets reversed course leading to the list of positive monthly returns above. Commodities remained mostly in positive territory throughout the month and had the second highest monthly return. It is only one month into the year, but Growth vs. Value dispersion continued the 2024 trend, despite the Technology sector down close to -3% for the month. This damage followed the news on DeepSeek – a Chinese AI-related company that claimed to have similar AI performance at a fraction of the capital spent on powerful chips like most other competitors. The relative cost difference was later challenged but the initial market reaction demonstrates the expected good news built into some of these tech companies.

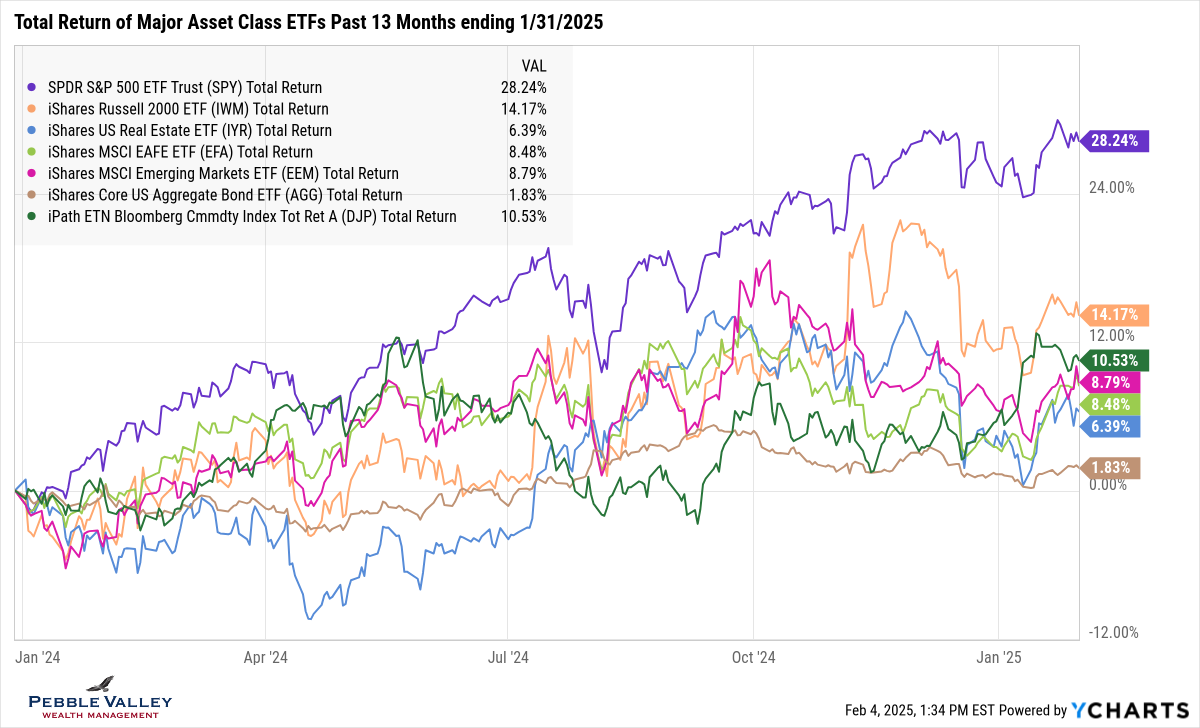

The graph below shows total returns of major asset class ETFs for the past 13 months. US Large Caps (purple line) and Commodities (green line) were able to recover the large gains leading in to and following the election but the others were not. US Small Caps, REITs and Emerging Markets were down the most early in January but as you can see, that was short-lived.

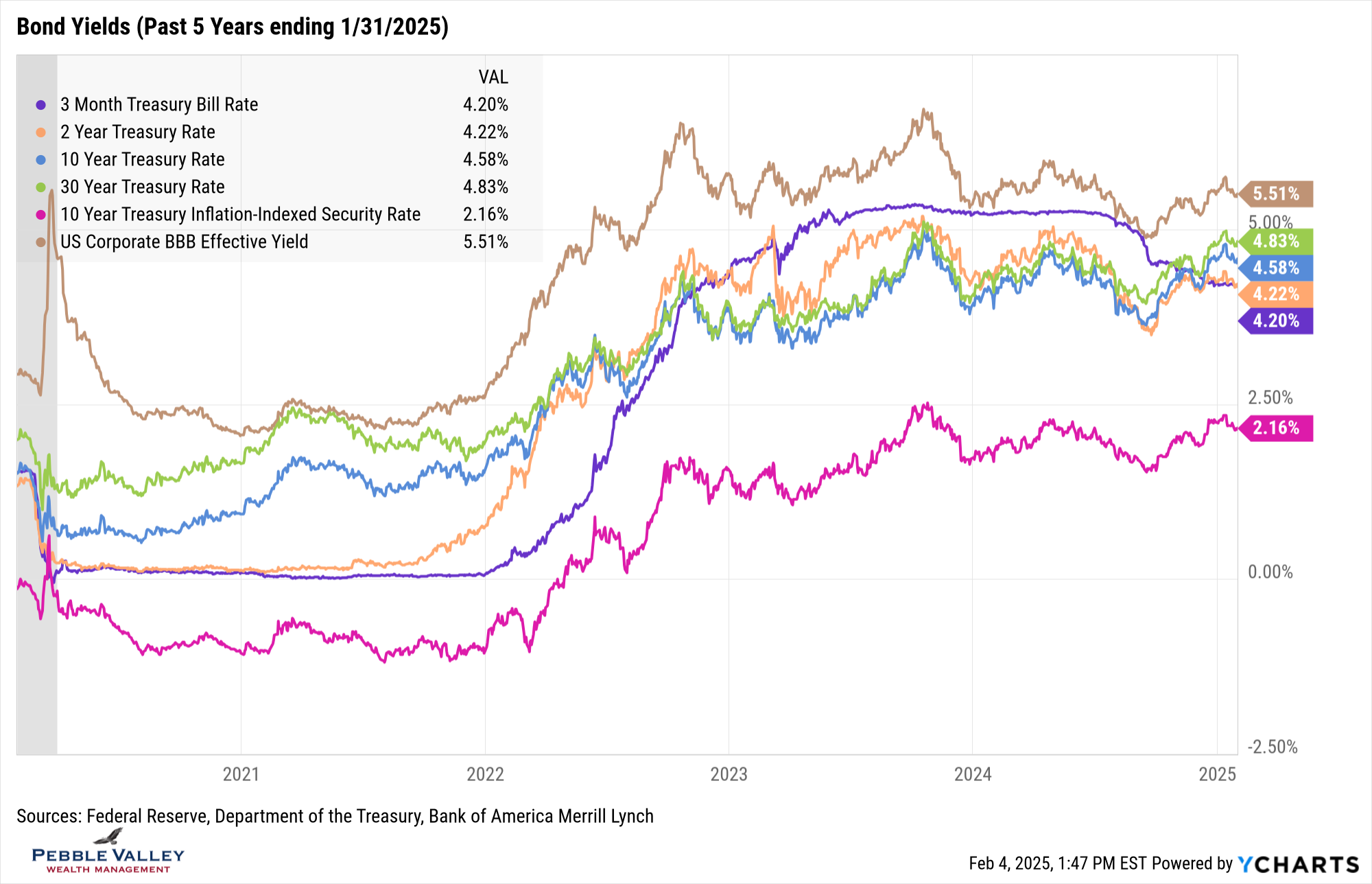

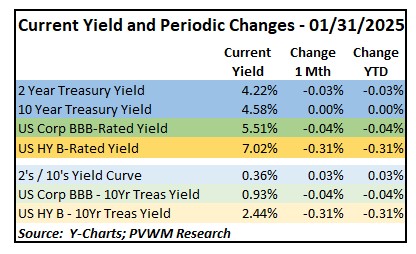

The first thing I noticed about the past 5-years of bond rates is that we are coming up on 5 years since the COVID pandemic fully kicked in. The second thing I noticed is the 10-year Treasury rate was the same at the beginning and end of January. Finally, for another month running now, we have a normal-shaped bond curve, with short maturity bonds having lower rates than longer maturity and real yields remain real. Credit spreads continue to stretch the true meaning of spread as the extra yield earned over credit-risk-free treasury yields remain very tight.

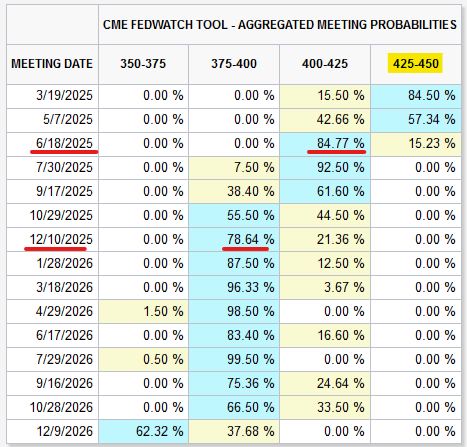

The last FOMC meeting on January 29th resulted in Fed Funds rates remaining at 4.25-4.50%. The press conference following the meeting reiterated the likely path is leaving rates here over the near-term and watching the economic data. The FOMC feels the current rate is “well calibrated”. The FOMC will remain independent from politics and is watching the Fiscal and Geopolitical environment. However, they will not take action based on expectations of what may happen but rather wait and see what changes are actually implemented before adjusting its policy. The market also believes the FOMC is likely on hold for awhile, pricing in the likely first cut in June and maybe another late in the year (per the CME Fedwatch tool).

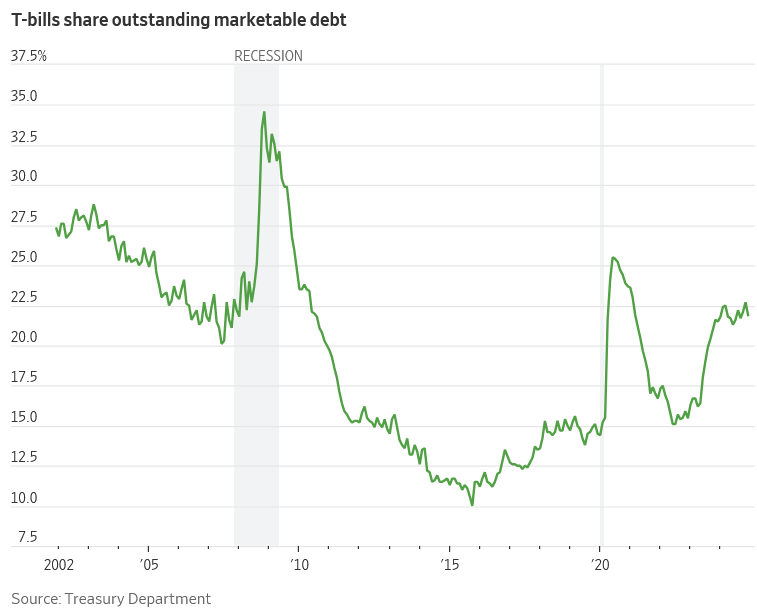

My special topic this month is Treasury’s Quarterly Refunding announcement to be released on February 5, 2025. Every quarter the Treasury Department estimates the amount of debt that must be issued and their intentions of the blend ranging from shorter-maturity bills to longer maturity notes. There has been an increasing reliance on short-dated Treasury Bills by the Treasury leadership starting in 2022 as inflation was taking off and longer-term rates were already under price pressure leading to higher rates (see graph below from WSJ). There is a private-sector Treasury Borrowing Advisory Committee that suggested the ideal range for T-Bills outside of emergencies (like COVID and Great Financial Crisis spikes in graph) is between 15-20%. The February 5th announcement will be the first from new Treasury Secretary Scott Bessent who has criticized the reliance on short-term borrowing in the past according to this WSJ article. Bond investors are watching.

I didn’t see my shadow in cloudy Chicago and so with a nod to Woodstock, IL I am optimistic for an early spring!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com