Year-End Tax Planning

Thanksgiving is next week! Then the stroll – don’t sprint! – to the Christmas season and year-end festivities begins. There are also some important year-end tax reminders and strategies to consider before that - and take action if necessary. The tax rules keep changing and particular nuances may warrant completely different treatment for what appears to be similar situations. So if your “Crazy Uncle” insists on a different answer at the Thanksgiving table, perhaps it was based on an old law or a unique situation. Now pass me some pumpkin pie…

Please note this is not formal tax advice. I am not an accountant, nor do I prepare tax returns. But as a financial planner, I understand these topics very well and perform detailed tax planning for our clients to give them more control and minimize tax surprises. Reach out if that sounds appealing.

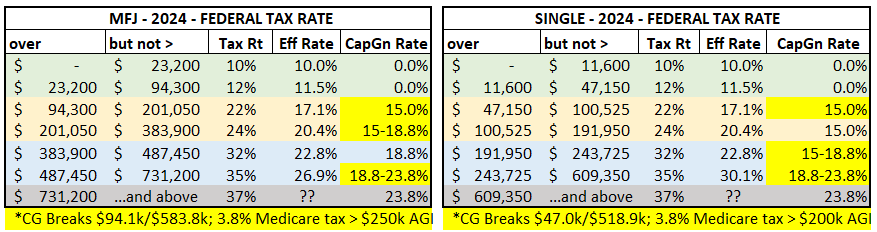

Marginal Federal Tax Brackets for Income and Capital Gains

- Table shows marginal tax rates to determine the dollar amount these actions can save

- Also see my blog post describing key lines of your tax return for a better understanding

Max out 401k/3b Employee Contributions

- Max contribution in 2024 is $23,000 plus extra $7,500 if 50 or older

- If working for company, must make via payroll deductions during 2024

- If self-employed with S-Corp, must also make via payroll deductions during 2024

- If self-employed as LLC or sole proprietor, get amount ready but can make in January

- After hit max and if 401k/3b allows, can also make “after-tax” contributions (different than Roth 401k/3b); ideally move to Roth IRA soon after contribution

- NOTE – Employer contributions for those self-employed can be made up to tax filing

- NOTE – IRA contributions can be made up to tax filing next spring

Required Minimum Distribution (RMD) for own Roth IRA or Roth 401k/3b

- NONE

- Note that “NONE” applies for Roth 401k/3b starting in 2024 thanks to Secure Act 2.0

Required Minimum Distribution (RMD) for own Traditional IRA or Trad 401k/3b

- Must begin withdrawing specified minimum amounts after certain age so the government can begin collecting taxes on deferred wage income

- Required starting age was 70.5, then 72 and is now 73 starting in 2023 (Secure Act 2.0)

- If turned 73 during 2024, can delay first RMD until April 1, 2025 but be aware must also make next RMD before December 31, 2025, so watch total income and bracket impact

- Amounts withdrawn not used for charity (see later) treated as ordinary income unless past non-deductible contributions (use Form 8606 to determine taxable amount)

- No, you can’t use your RMD for a Roth conversion

- Sell a specific security (no tax on sale, just withdrawal) to refine allocation if overweight

RMD for inherited IRA or 401k/3b – INCLUDING ROTHs – if person passed before 2020

- Must take RMDs based on pre-Secure Act rules

- Yes, Roth IRAs must take RMDs from inherited IRAs each year in this category

RMD for inherited IRA or 401k/3b – INCLUDING ROTHs – if person passed in 2020 or later

- New rules apply thanks to Secure Act 2.0

- For this blog, I will not address rules for “eligible designated beneficiary” (spouse, minor children, disabled, chronically ill, less than 10 years younger)

- Must withdraw all funds by the 10th year following year of death

- For Traditional IRAs/401k/3b if the decedent was already taking RMDs

- RMDs are required during years 1-9, but were waived for years 2020-2024

- Starting in 2025 you must begin taking RMDs

- For Traditional IRAs/401k/3b if the decedent was NOT taking RMDs

- No RMDs required, but must deplete by 10th year

- May want to spread out withdrawals to avoid bumping into higher tax brackets

- For Roth IRAs/401k/3b – by definition the decedent was not taking RMDs

- No RMDs required, but must deplete by 10th year

- Unlike Traditional, since Roth withdrawals not subject to tax, can wait until last year if wish without potential negative tax implications

Qualified Charitable Distributions (QCD) for own or inherited IRA – but NOT 401k/3b

- Only applies if above age 70.5

- Yes, must wait until “.5” in year 70

- Yes, the age is still 70.5; was NOT changed like RMD in Secure Act 2.0

- Able to make direct contribution to qualified charity and have withdrawal count toward RMD if applicable, but be sure to “save” part of RMD amount from other withdrawals

- Maximum amount is $105,000 for 2024 (indexed to inflation starting in ‘24)

- Attractive for charitably inclined who may be taking much higher standard tax deduction

- Also reduces income for Medicare IRMAA (see later) while itemized deductions do not

- BE SURE TO TELL ACCOUNTANT next spring; is not shown on Form 1099-R

Review realized capital gain/loss and search for harvesting – both losses and possibly gains

- Recall gains from security held more than 1 year get favorable tax treatment; if 1 year or less it counts toward ordinary income

- Any losses offset gains, first short against short and long against long, then each other

- If losses exceed gains, can reduce ordinary income up to $3,000, then carry forward rest

- Be careful with “wash sale rules”; can’t buy back same or substantially similar +/- 30 days – this includes in spouse account if joint filer or buying in own IRA!

- If in 12% or lower income bracket (approximately), capital gains rate is 0% so may harvest gains; note state tax may apply!

- Extra 3.8% Medicare tax kicks in at $200k / $250k AGI for Single / MFJ

- Extra 5.0% tax kicks in around $519k / $584k taxable income for Single / MFJ

- Don’t forget about mutual fund distributions if held in taxable account; see funds’ websites for estimates; better yet, hold ETFs in these accounts!

Partial Roth Conversions

- This gets complicated and requires not only current year taxable income estimates (including all factors above) but also expected future taxable income, including SS

- Recall withdrawals not used for charity from Traditional IRAs and 401k/3b count as ordinary income unless past non-deductible contributions (see Form 8606)

- State tax differs but be aware of impact; some states don't tax IRA withdrawals, including conversions

- The general concept is to convert part of a Traditional IRA/401k/3b into a Roth if in a lower or same tax bracket as expect to be in the future

- There are other more nuanced considerations won’t address here

- Ideally pay tax from other account, not part of conversion

- Requires “estimated tax payment”; be aware of deadlines

- If under age 59.5 definitely pay from other account or tax amount hit with 10% penalty

- If age 63 or older, be aware of Medicare IRMAA premiums and how conversion impacts

- Yes, Medicare starts at age 65 but IRMAA check uses tax return from 2 years prior

Fund Donor Advised Fund (DAF)

- If charitably inclined and in high tax bracket and/or large unrealized gains on securities

- Able to contribute now and get deduction in current year (up to % of AGI), then make charitable contributions from DAF in future years – with no deduction

- Can contribute cash but additional tax benefits if contribute appreciated securities

- Doing larger amount in single year gets some taxpayers above the standard deduction

- May allow for additional Roth conversions if done in same year

- NOTE this deduction is “below the line” so does not help with Medicare IRMAA bands

College Savings Plans (529s) – both funding and reimbursement

- Recall no Federal tax deduction on contributions but some states allow, up to limits

- Contributions must be made before end of year

- Investment gains are not taxed at Federal and State if used for qualified education costs

- 529 reimbursement – the fun part! – must also be done before year-end for any qualified expenses incurred during 2024

Review funds left in Flexible Spending Account (FSA) and consider remaining medical expenses

- Recall an FSA is “use it or lose it” each year – unlike Health Savings Accounts (HSA)

- While I wish you good health, if there are upcoming medical needs (or dental or eyeglasses) be sure to incur the expense before year-end if a balance left in FSA

- Some FSA plans may have a grace period which extends the deadline into March

- Some FSA plans may allow a separate “carryover amount” of $640 for 2024

Review year-to-date tax withholdings vs. expected total taxes due and adjust

- If you are still with me, you must really like tax planning so let’s get in the weeds here

- Throughout the year you have taxes withheld from paycheck and/or paid via estimated tax payments due 4/15, 6/15, 9/15 and 1/15 of next year

- To avoid a tax penalty (costs more recently with higher interest rates) you want at least the amount withheld that puts you in the “safe harbor” zone

- If expect to fall short of “safe harbor”, update Form W4 with employer and specify extra dollar amount per paycheck (adjust back in Jan!) or pay estimated tax by 1/15 next year.

Who said taxes aren’t fun. Ok, maybe not fun, but there are plenty of actions one can take now rather than complaining about the large tax bill next spring. Grab your piece of the pie! Happy Thanksgiving!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com