It’s Happening… Annual Benefits Enrollment for 2025

If you haven’t yet, you soon will receive notice about the upcoming annual benefits enrollment from your employer. This enrollment period allows employees to update benefit choices and review new benefits. For relatively new hires, this may be a welcome opportunity to revisit decisions made during the first month on the job when you were drinking from a fire hydrant. There are some of you that view this as an annoying annual ritual to passively click on last year’s choices – I recommend not doing that!

This is based on a past blog post to serve as a friendly reminder and update latest limits.

I recommend taking the time to review the full list of choices as new options may appear or life circumstances may dictate different choices. Here are some things to look for.

Note: Current year tax savings for each $1,000 tax-deductible contribution saves both marginal Fed tax rate plus state. If in 12% Fed bracket and flat 5% state tax, the savings per $1,000 is $170; if in 22% Fed the tax savings jumps to $270 - so worth looking at. For top bracket employees – 37% + 5% in my example – a whopping $420 per $1,000 tax savings for current year. Now that I have your attention let’s proceed.

401k/403b and Retirement Savings

Technically this is not part of the annual benefit enrollment since you can change your elections to participate, contribution amount and of course investment selections throughout the year. However, this is a good time to review if any investment choices were updated, especially more bond fund choices (or just review them if haven’t in a while!), verify the latest crediting rate on Stable Value Funds (very likely lagging current yields) and see if both Traditional and Roth are offered. If in lower tax brackets now it likely makes sense to use a Roth but don’t overlook any state tax deductions and consult an advisor if need help. Be very careful when entering your contribution % as there are different boxes for ‘pre-tax’, ‘Roth’ and for some plans ‘after-tax’ (see below).

Two other features to look for is an after-tax contribution (different than Roth) which allows for additional savings above the $23.5k limit for 2025 that can be converted to a Roth IRA after contribution. The other is a 457 Plan common if work in education or hospitals that may allow you to save an additional $23.5k depending on the plan. If 50 or older you can make an additional $7.5k in 2025 (same as 2024) catch-up contribution to 401k/3b/457. And new in 2025, thanks to SECURE Act 2.0, employees ages 60 – 63 get an even higher catch-up contribution of $11,250. You will have to ask the drafters of the Act why the limited age band! Finally, check if the company offers a pension plan (not many companies do) and appreciate the extra value of that benefit vs. competing job offers.

While not part of employee benefits, for those wondering about the contribution limits for IRAs in 2025 - $7,000 if under age 50 and the same extra $1,000 catch for those older (same as 2024).

NOTE: The SECURE Act 2.0 required that employees with income in previous year from same employer above $145,000 to contribute $7.5k catch-up contribution to a Roth 401k only. However, that requirement is delayed until 2026.

Health Insurance

This is by far the benefit that gets the most attention and aside from retirement savings, likely takes the most out of your deductions. Verifying the network of doctors in a plan is a priority for most, but don’t overlook the different deductible choices given your utilization and the trade-off of a higher deductible (the amount you pay before insurance kicks in) with lower monthly premiums. Also verify if routine physicals and other preventive services are covered without hitting the deductible first. This can make the high-deductible plans more tolerable – trading known lower monthly premiums in exchange for unknown potential medical bills before hitting the higher deductible.

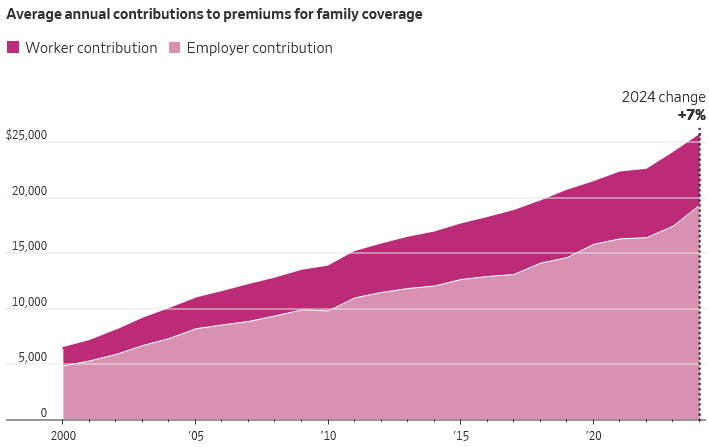

The graph below (Source: WSJ) shows the average cost for family coverage for traditional plans. If an employee leaves a company before eligibility for Medicare at age 65, they are often surprised at the high cost of medical insurance. This is because the employer has been paying a large portion of the cost.

Health Savings Accounts (HSA)

Related to the health insurance choice is whether a particular health plan allows contributions to a health savings account (HSA). Some employers even contribute a portion so factor that in your decision. To qualify, your underlying health insurance plan must be a High Deductible Health Plan (HDHP). For 2025 the minimum deductible for an HDHP is $1,650 for individual and $3,300 for family. The max out-of-pocket amounts are $8,300 individual and $16,600 family. Be sure this potential out-of-pocket amount fits your or family needs. If so, choosing this plan with an HSA allows a fully deductible contribution (you + any employer combined) of $4,300 for individual and $8,550 for family for 2025 tax year. There is also a $1,000 (same as last year) catch-up contribution if over age 55 (not 50 like an IRA). An important distinction is that funds contributed to an HSA do NOT need to be spent each year. In fact, ideally health expenses can be covered from other funds and let this account grow tax-free if later used for medical expenses.

Health Flexible Spending Accounts (FSA)

A very similar sounding but very different account type is an FSA. These accounts allow tax deductible contributions of $3,300 per FSA for 2025. If a working spouse also has an FSA an additional $3,300 can be contributed to their plan but you can’t submit the same expense to each plan. As you incur out of pocket medical expenses you request reimbursement from the FSA. You do not need to have an HDHP plan to utilize these accounts. However, a key distinction is if not enough medical expenses were incurred to drain the account from reimbursements for a given calendar year, you forego most of the remaining balance. For 2025, you are allowed to carryover $660 of unused funds into the following so be sure not to overfund your expected out of pocket health costs.

Dependent Care Flexible Spending Accounts (DCFSA)

Similar to a Health FSA, a similar account type is available for dependent care expenses. Obviously not related to a given health plan but you do have to have qualified dependent care expenses. Tax deductible contributions of $2,500 for single or $5,000 for family are allowed for 2024 (I don’t have 2025 values yet). A family in the 22% bracket with flat 5% state tax would see a tax benefit of $5,000 x (.22 + .05) = $1,350 tax savings. That’s a lot of diaper money.

Disability Insurance

Have you ever seen those AFLAC commercials? That is referring to short-term disability. But what if you had an injury or illness that prevented you from working for more than a few months? Long-term disability insurance provide income if this happens. Not all employers will offer this benefit and some may offer but the employee must pay the premiums. It is a very good idea to take this coverage. This insurance covers a % of your salary – typically 60% or 67% - up to a cap of say $10,000/month. There is a deductible expressed in months (usually 3) before the benefits begin. It may cover your own occupation disability for the first 2 years, then you must be unable to do any occupation after that to qualify for continued benefits (check details of plan). Most people wouldn’t hesitate to get life insurance if they have children but don’t think about disability insurance. This is equally as important. Disability insurance is also recommended even if don’t have children because it is your future earning power while alive but disabled that is covered. The chance of becoming disabled during working years is greater than death.

Life Insurance

Most employers may pay for a base amount of insurance expressed as multiple of salary – typically 1x or 2x salary. Amounts above $50,000 generate some pesky tax implications you might see on your paystub. Additional life insurance amounts are offered for purchase with no underwriting. Because of the potential for adverse selection, you can likely find better rates if purchased outside of the company. This is a convenient option with annual renewals (and rising premiums) but you pay for that convenience. Also note the amount you pay may seem low relative to say a 10- or 20-year level term quote from outside the company. Be aware the annual premium from work policy will go up each year based on age while the level term quotes are fixed for that duration.

Other Benefits

Other types of benefits may also be offered. Vision, dental, wellness, legal advice, commuter costs and educational reimbursement are some common benefits. Review what is offered to see if have an upcoming need over the next year and weigh the cost vs. alternatives.

If you are fortunate enough to have a solid benefits package, be sure to take a closer look this year and select the benefits that fit your latest needs – at least for the next year!

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com