College Financial Tips for both Parents and Students

Some kids are going off to college. Some ‘older kids’ wish they were. There are many exciting (and some stressful) things being planned. Financial-related topics are likely not at the top of your list, but here are a few for both students and parents.

Students – Embrace the special phase of life

Be curious and have fun! If this is your first year, some aspects may seem a little overwhelming. Be sure to ask questions. For returning students, it is more familiar but you may have new living arrangements. Regardless, enjoy the focused academic education and the broader life education. … and be sure to call your parents and loved ones!

Parents - Withdrawing Funds from 529 Savings Plan

If you have been diligent about saving for this day in a 529 savings plan, now comes the fun part – withdrawing the funds to cover the bills. Here are some common questions with answers. For general information on 529 plans see my past blog post.

What expenses can be reimbursed from a 529 Savings Plan?

- Sources: IRS Publication 970 or 529 Plan Document

- Tuition, fees, books, supplies and equipment required by the school

- Room and board (if enrolled at least half time); includes living off-campus, provided less than room/board school uses

- Purchase of computers and peripheral equipment, software and internet access provided for academic needs

- No more than $10,000 to pay off student loans for 529 beneficiary or siblings (confirm your state plan allows – Illinois does)

- NOT ALLOWED: college application fees, transportation, insurance, sports/club/social fees, furniture/decorations.

- NOTE: if have a 529 PrePaid Plan that ONLY COVERS TUITION.

Where are the funds sent from the 529 Plan?

- Request a withdrawal from 529 Plan (select “qualified expense”) and enter where funds go; a few choices:

- directly to school for tuition and room/board if on campus

- to 529 owner (you!) for reimbursement or send to necessary party

- directly to 529 beneficiary (the student) for any reimbursement

- I personally had an ACH connection to my checking account where all funds were sent, then I paid either the school or reimbursed my child when living off campus

- NOTE: if have a 529 PrePaid Plan those funds must go directly to school

When should you withdraw from the 529 Plan?

- Funds can be withdrawn after bill paid but be sure to withdraw in the same calendar year the expense was incurred

- I kept receipts for big ticket items (school statements, computers) but not monthly off-campus living – but verified below college room/board

- Allow at least a week for selling and settlement of 529 securities and ACH transfers in/out of checking account

- Yes, funds can go directly from 529 to school but be sure to set up address in 529 payee list and allow enough time for funds to arrive

- NOTE: if have a 529 PrePaid Plan check with plan; if covering out-of-state school likely requires even more time… and a lower factor applied to funds!

Any investment or savings considerations while doing the withdrawals?

- Unlike retirement savings, college time horizon is much shorter (kids grow quickly!) and all funds typically depleted over 4 years

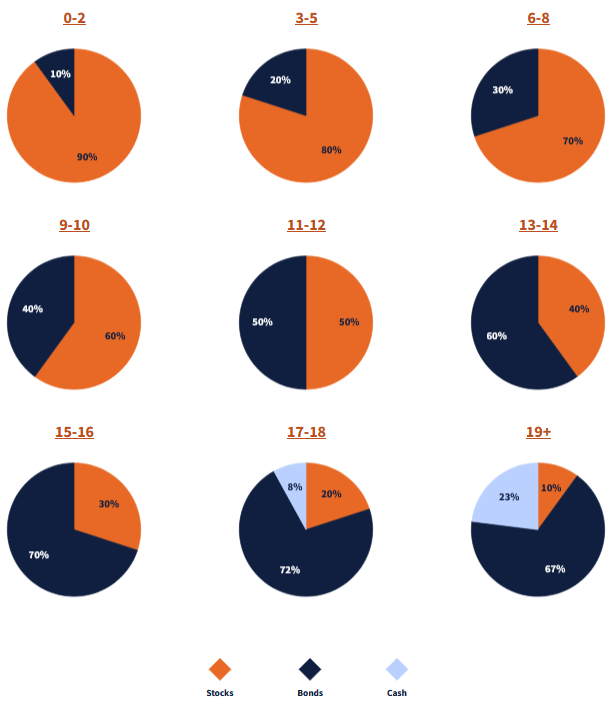

- Be sure the 529 investment risk is reduced as college age approaches – either automatically through “age-based” portfolios or own rebalancing

- table below shows IL plan allocations; be careful with bond duration!

- Since only can make investment changes twice per year, take withdrawals from funds want to reduce for allocation reasons (n/a for age-based option)

- If more savings needed, likely make contributions into 529 even while withdrawing if your state plan offers a tax deduction on contributions

- If qualify for American Opportunity Tax Credit (MAGI < $80k single, $160k MFJ (partial up to $90k/$180k), consider paying $4,000 of tuition out of pocket for $2,500 credit/child. Talk to your accountant.

- If excess funds in 529, can change beneficiary to other family members, leave for future education needs, or use portion to fund Roth IRA (if qualify)

- If do withdraw for non-qualified expenses, investment gains only (not full principal) count as income plus 10% Fed tax penalty; state likely recapture past contribution deductions if applicable

- If student got scholarship and won’t need all funds, can withdraw that portion without 10% penalty; some tax consequences on earnings (but no worse then if used taxable account)

Parents and Students – Covering college costs portion not saved for in advance

If you weren’t able to save full amounts in advance then funds will need to come from some combination of parents and/or student. This may be adjusting the parents’ budget, student loans (see FAFSA below), parent loans, or tapping the equity in different assets like home or insurance policies. Be aware the interest rate on home equity lines are quite high these days, but so is the 9.08% rate on Parent PLUS loans. Current rates on Federal loans for undergrads is 6.53%; graduate students pay 8.08%.

Parents – Establish Power of Attorney Health Care for Child

When your child turns 18 they legally are an adult with the authority to conduct financial transactions and control their own privacy. This also applies to healthcare. The school will likely have students sign paperwork allowing parents access to the healthcare information and decisions. It is a good idea to establish a Power of Attorney – Health Care in case care is needed away from the school facilities or if paperwork or forms are requested to be sent somewhere.

Parents and Students – Complete FAFSA for potential aid and student loans

Ok, mostly parents will complete! Surprisingly the Federal deadline for an academic year goes until June 30 (after students are out), but you want to apply much earlier than that – typically in the fall before the next academic year. In the past the form was available as early as October for the next academic year but there were major delays last year. There may be additional delays for the ’25-’26 academic year to be aware of.

Completing this form helps inform any potential aid from the school but also is required if the student plans to take out a student loan, or the parent from the PLUS program. So even if you think income is too high to qualify for aid, there are other benefits for completing.

Parents and Students – Talk about who is paying for ‘extra activities’ and reasonable spending amounts

There may be many different approaches ranging from the student covers all expenses to the parents covering amounts up to a target amount. And the approach you take will very likely differ from at least some other students your child will meet and interact with. Having the open discussion now about where the money comes from, who is responsible for paying the amount, and spending guidelines will be welcome on both sides and make future money conversations go smoother with no surprises – or at least minimized.

Some schools have “college cash” that can be added to the student ID card. If you decide to get a credit card for the student, consider keeping the credit limit lower (can use parent’s card for airline tickets). The parent may need to co-sign on the card since the student likely has limited credit history. Monitor the balance and be sure that timely payments are being made. Do not get in the habit of running a balance that cannot be paid off each month.

That’s enough for the financial tips. Enjoy the many non-financial related topics and activities as well. This is an exciting time for both students and parents. Embrace the excitement. And students… remember to call your parents and loved ones.

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com