Asset Class Returns - 2/28/2025

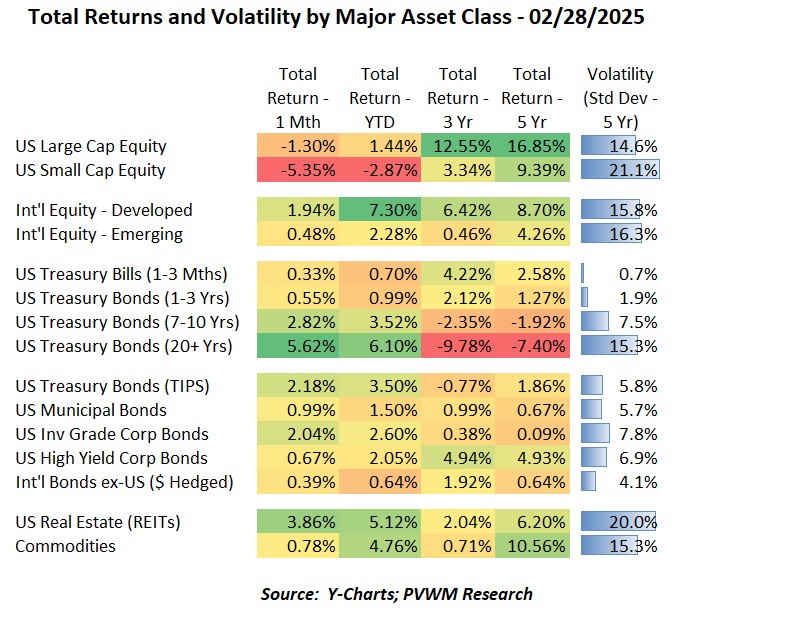

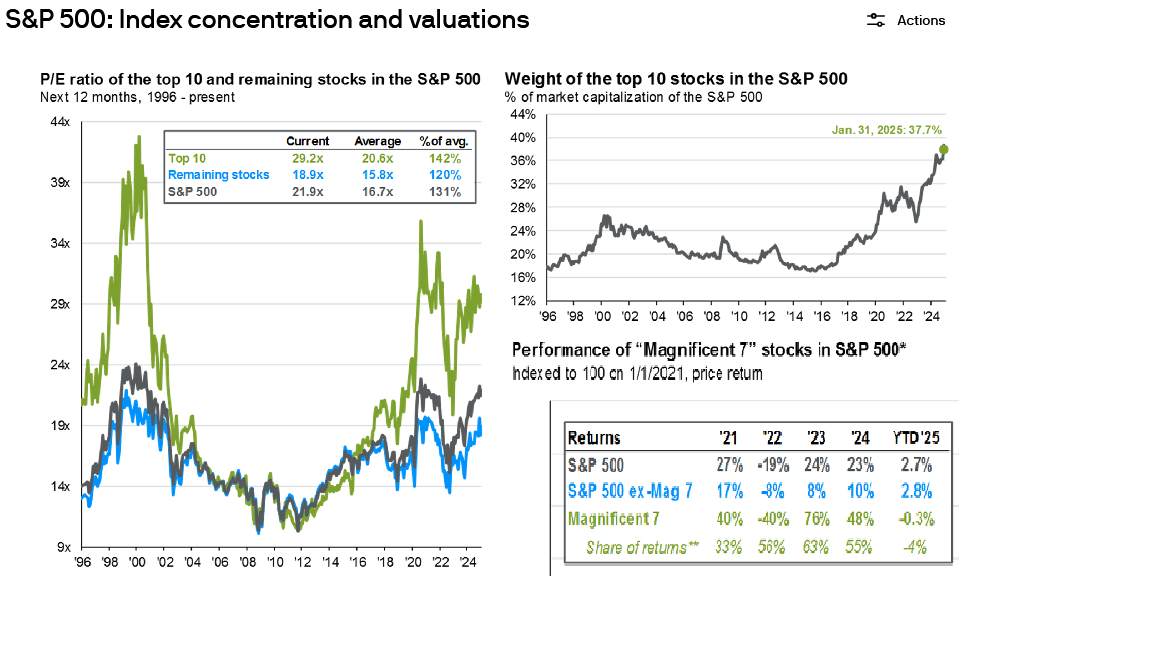

The only negative returns for the major asset classes this month are US equities, with Small Caps taking the brunt of the sell-off. Most of the Large Caps pain was felt in Technology and Consumer Discretionary (which includes Amazon and Tesla) as outlooks during latest earnings calls were tempered a bit. Note the top 10 stocks make up close to 38% of S&P500 market capitalization. The Magnificent 7 (AAPL, AMZN, GOOG/GOOGL, META, MSFT, NVDA, TSLA) drove 55% of the S&P500 returns in 2024 but are a drag in 2025 (Source: JPM Guide to Markets, 1/31/2025) so their swings both up and down will be noticed (see graphs below). US REITs had a solid month on the back of falling interest rates. International equities – both Developed and Emerging – were positive for the month; the Developed markets are leading YTD returns at +7.3%. Recall these asset classes were tough to hold relative to the high-flying US equities over the last few years. Commodities were up slightly for the month with Industrial - not Precious – Metals leading the way. All major bond indices did well on the back of falling interest rates, especially longer Treasuries and TIPS. High Yield credit spreads widened slightly, tempering their total return.

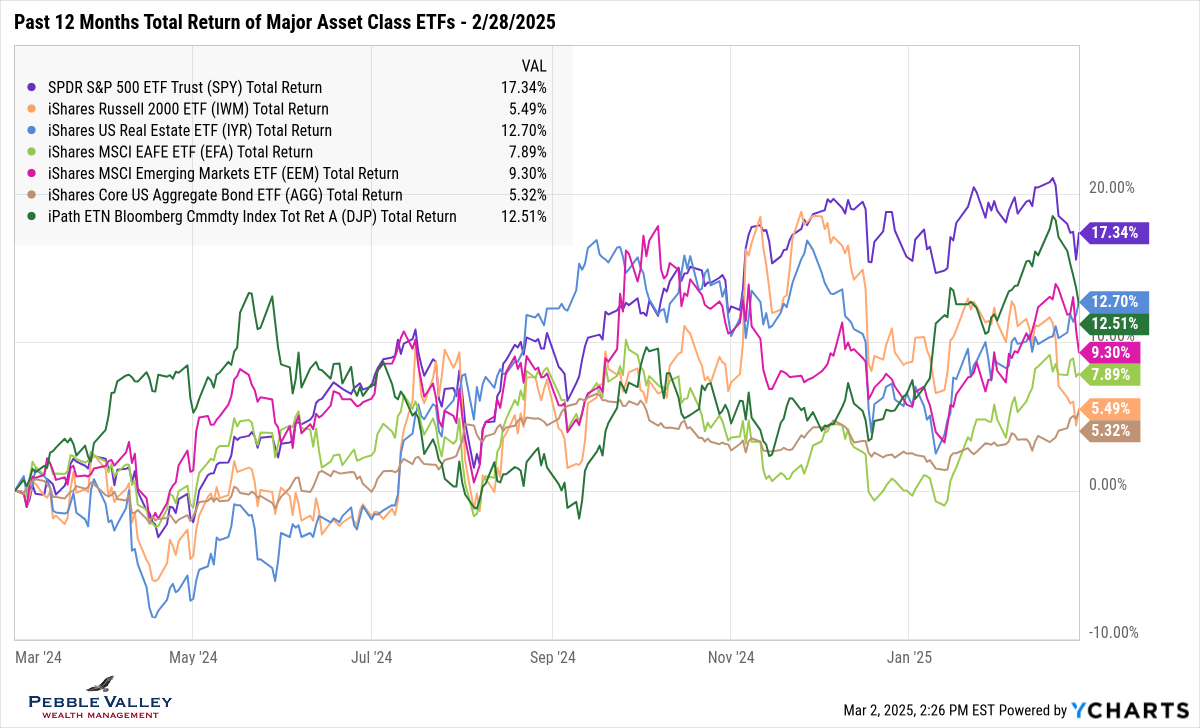

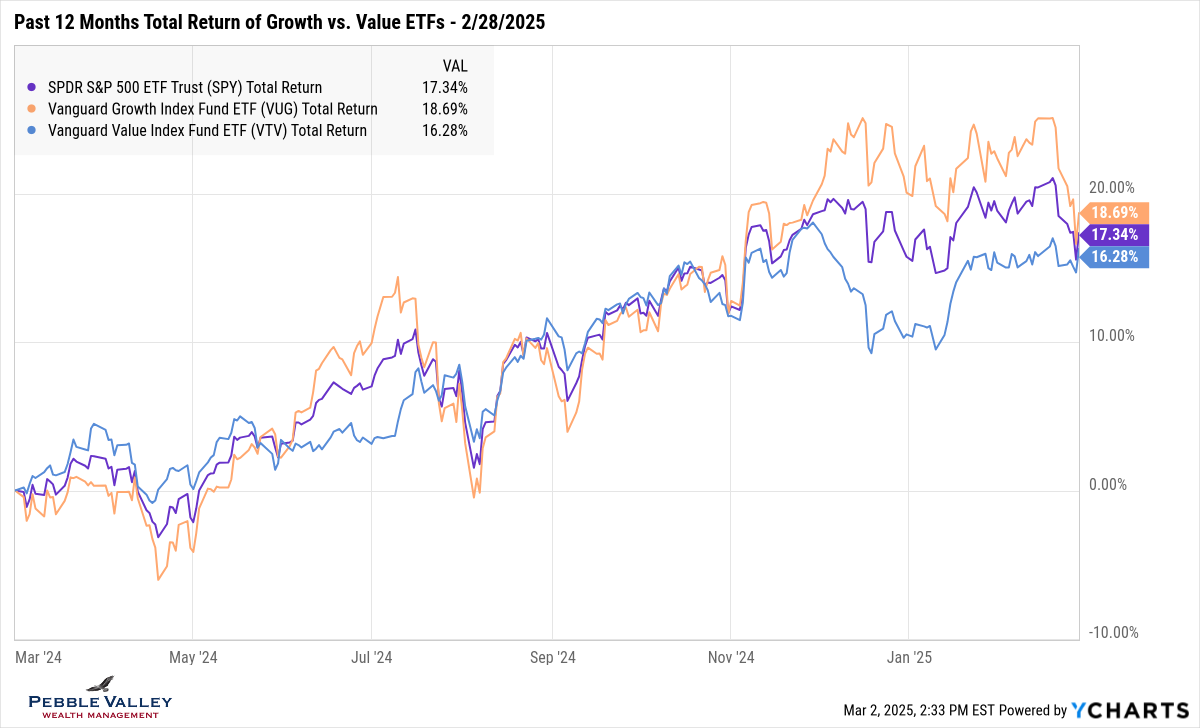

The graph below shows total returns of major asset class ETFs for the past 12 months. US Large Caps (purple line) continue to lead the pack but REITS (blue line) nosed ahead of Commodities (green line) this month. You can see the end of February was not kind to many asset classes. Two asset classes that kept charging ahead were REITs and Bonds, as the falling interest rates put wind in their sails. International equity also remained flat which is a ‘win’. Last month I commented on the Growth vs. Value dispersion, which was widening. The last part of February saw Growth stocks take a hit while Value held its own. You can see in the second graph the past 12 months’ returns are once again on top of each other as the dispersion collapsed.

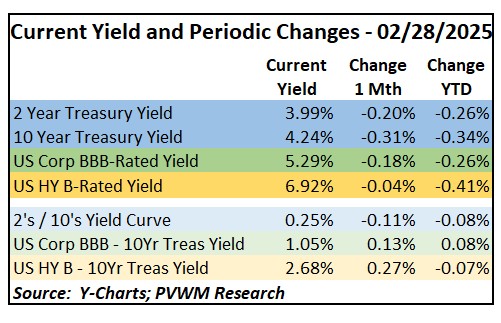

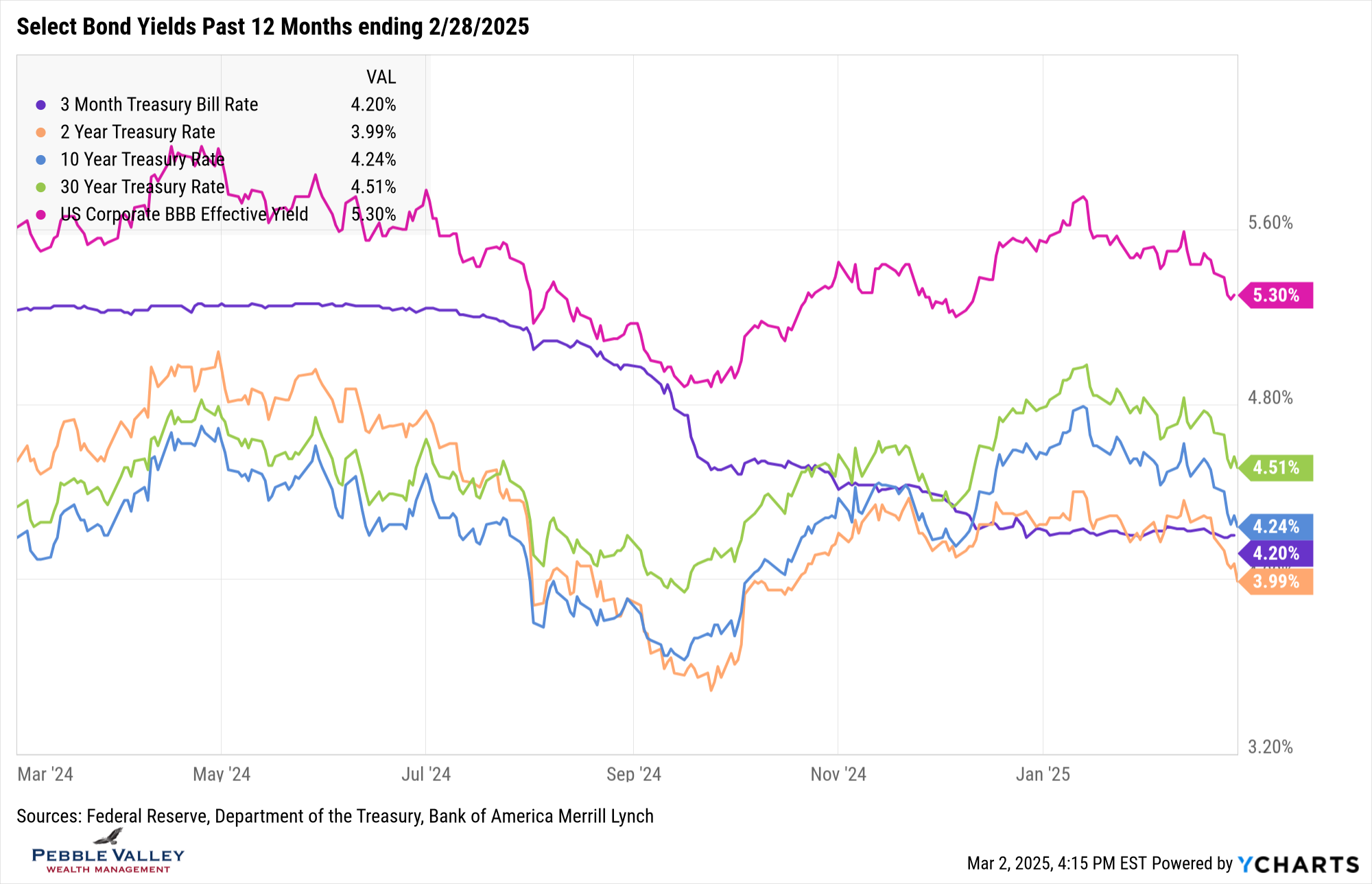

Interest rates fell quite a bit this month. They were drifting lower at the beginning of February and then temporarily jumped after a hotter than expected CPI report came out on February 12th. Following that brief blip up however, rates turned down again and didn’t stop, helped by Treasury Secretary Bessent stating the goal of bringing the deficit down from 6% to 3% of GDP with reliance on combination of spending reductions with the DOGE effort and higher GDP growth as more spending shifts from government to more productive private sector efforts. I also show a similar graph but drop the TIPS and only include past 12 months so you can see these recent moves. Note the 2-year yield dropped back below the 3-month TBill again.

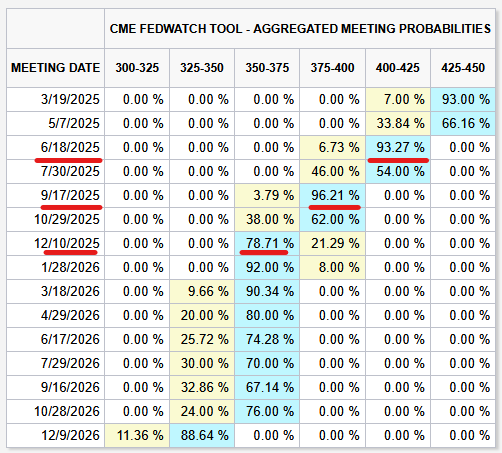

The next FOMC meeting is March 19th. Current Fed Funds rate remains at 4.25-4.50% and the Fed Funds futures implies that the market expects the rate to stay there. The excitement of this meeting – in addition to the likely first meeting after announced tariffs go in effect – is the release of the Summary of Economic Projections. These projections are updated four times a year and created a surprise at the last release in December. Four key components projected by the 7 Board of Governors and 12 Fed Reserve Bank Presidents are Real GDP, Unemployment, PCE Inflation (both headline and core) and Fed Funds rate (i.e. “the dot plot”). I was also surprised by the additional rate cut the market is now pricing in by year-end relative to last month (see table again this month; Source: CME Fedwatch tool on 2/28/2025). Last month only two rate cuts (375-400 column) were the majority weightings from 10/29/25 all the way down to 10/28/2026!

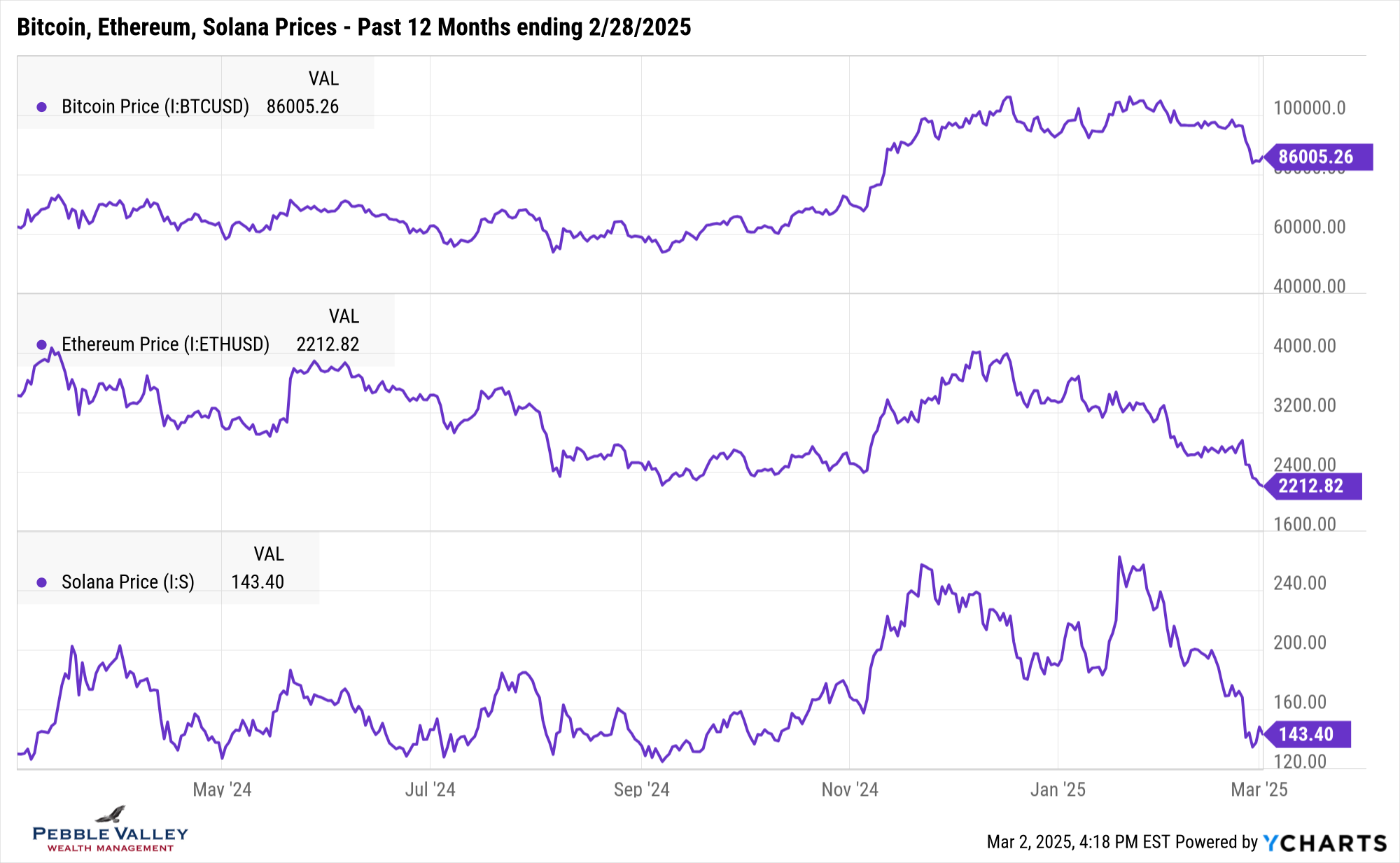

My special topic this month is crypto. I recently updated my internal “Digital/Crypto Assets Background” document that I shared with our clients. On the negative side, two things I mentioned in the “Risks to consider…” section of my document were present in February:

- extreme price volatility (can be 5x more volatile than S&P500 – both up and down!); and

- potential for theft (which occurred on a non-US exchange).

The recent price drop also coincided with pullback in technology stocks as the risk-off mode kicked in, in addition to the theft news, which had a smaller reaction than I was expecting.

On the positive side, two recent developments (Source: Bitwise Investments) mentioned in the document that are being amplified this weekend (I’m typing this on March 2) are:

- “Morgan Stanley Opens the Door for Bitcoin” which is now being amplified – dare I say an “11 on the dial” – from the announcement this past Friday that BlackRock will add a 1-2% Bitcoin ETF (IBIT) allocation in its target allocation portfolio that includes alternative assets; and

- “Politicians embrace crypto” being amplified from the announcement just a few hours ago of a US ‘Crypto Strategic Reserve’ that would include not only Bitcoin but other cryptocurrencies as well (Source: @davidsacks47 via X; David Sacks is the White House A.I. & Crypto Czar).

I was planning on adding this special topic even before this Crypto Reserve news broke. I don’t want to imply I’m chasing a hot story but the price reaction is quite significant, at least initially. Since the crypto markets trade 24/7 you can see the immediate impact of this announcement is about 10+% jump in prices.

Below is a 12-month price graph of three major crypto tokens – Bitcoin, Ethereum and Solana. While all three caught a bump in prices after the election, Ethereum and Solana retreated back to levels (or even lower) over the past year. Note the graphs are as of close 2/28/2025 and do NOT reflect the jump mentioned above. If considering entering, decide on total % of portfolio (probably smaller than you think) and consider legging into the total position.

March is here! Daylight Savings Time begins next weekend, warmer temperatures should follow and we all can become bracketologists as “March Madness” does its thing.

Have questions? Reach out! We're happy to help.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com