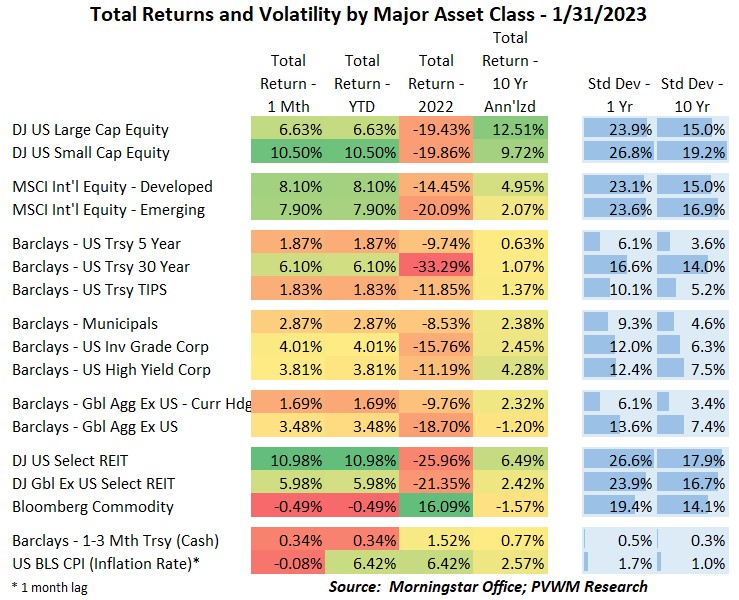

Asset Class Returns - 1/31/2023

The market said “Let’s go!” for the first month of the year as it put 2022 in the rear-view mirror. Glancing at the table above, the one-month returns are approximately in line with long-term full year returns, save for some bonds and commodities. And this was before the February 1st FOMC meeting which added another 1-2% on top of these returns if we add a day. One must remember there can be technical factors that drive price – buying back after tax-loss selling, beginning of year asset positioning, short-covering positions established ahead of an important Fed meeting, etc. Clearly there were more buyers than sellers!

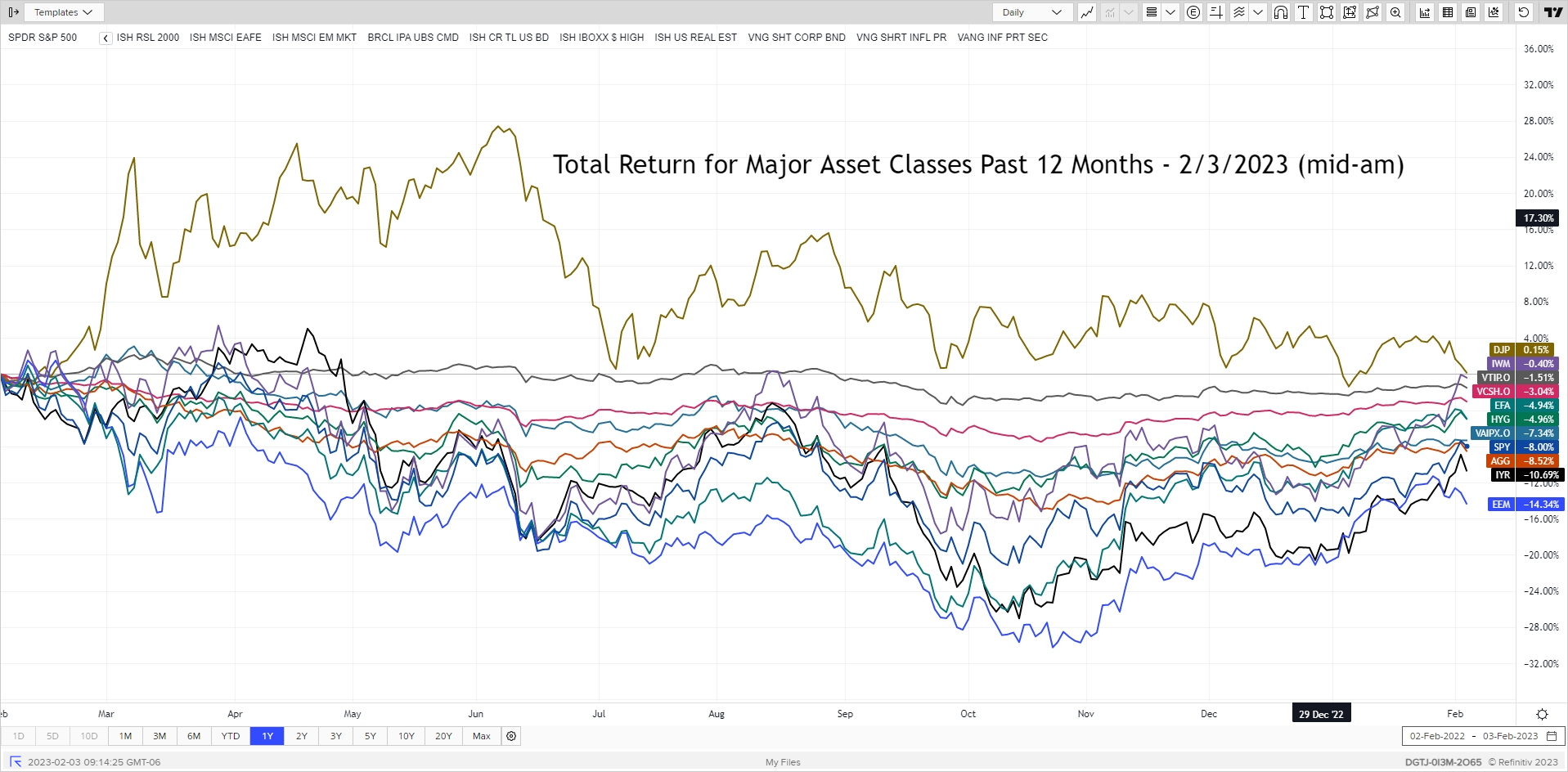

The major asset classes graph below shows the total returns for the last 12 months. I do include commodities on the chart at the expense of some granularity for the lower returning asset classes. You can see the large move up in returns since the beginning of 2023 for most asset classes except commodities (DJP) and bonds (AGG). The US small caps (IWM) really shot up this past month while emerging markets (EEM) tailed off the last couple days after a solid month of January. The other asset class to note is REITs (IYR) which had the strongest return in January but also tailed off since month-end. For this brief one-month YTD metric, Growth is outperforming Value and Tech and Consumer Discretionary beating out the defensive sectors like Staples, Healthcare and Energy. Surprisingly (due to falling rates) Utilities had the lowest sector YTD return… but again, a very short time period.

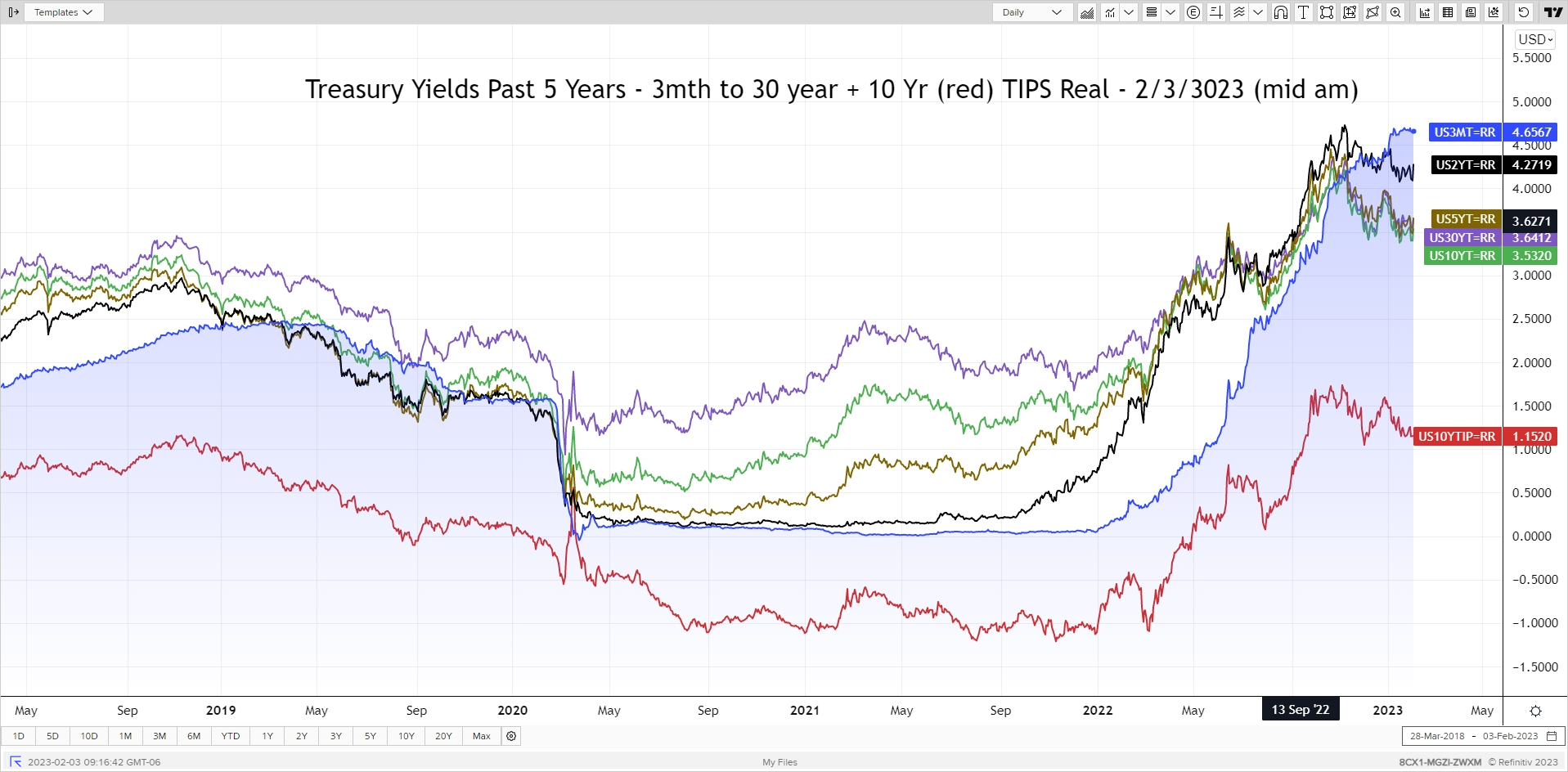

Rates have come off their peak from early November and despite an attempt to rise late into last year, January saw bonds rally in prices (which means a drop in yield) as the bond market continues to push against the Fed. The Fed expects to continue raising rates (though nearing the end) but then plans to keep rates high throughout the year. The bond market expects the Fed is done raising rates (or maybe one more 0.25% hike) but will then have to begin cutting rates later this year. The famous words on two different views of investing – “we’ll see.” With the new calendar year, those fans of I Bonds have another $10,000 allocation. The current rate is 6.89% (includes 0.40% fixed rate this time!). And the lovely 3-month T-Bills are now yielding over 4.65%!

The FOMC meeting concluded its meeting on February 1st. Recall that 2022 ended with the Fed raising rates by 0.75% four times in a row, then 0.50% at the December meeting. This time they raised Fed Funds rate by 0.25% to a target range of 4.50% to 4.75%. As a public service announcement, HOME EQUITY LINES OF CREDIT also went up 0.25%. As another public service, recall the Fed’s balance sheet also is running off at a pace of $60 billion/month of Treasuries and $35 billion/month of mortgage-backed securities. I mentioned earlier the bond market is fighting the Fed. Two quotes from Fed Chair Powell at the press conference following the FOMC meeting (as quoted by Nick Timiraos Thursday in a WSJ article) captures two key points in my mind. I’m on Powell’s side.

“Certainty is just not appropriate here,” said Mr. Powell. “I’m not going to try to persuade people to have a different forecast, but our forecast is that it will take some time and some patience, and that we’ll need to keep rates higher for longer.”

“I continue to think that it’s very difficult to manage the risk of doing too little and finding out in six or 12 months that we actually were close but didn’t get the job done and inflation springs back,” Mr. Powell said.

I hope your first month of this exciting 2023 year was a good one. Only eleven more left – make them count!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com